kansas inheritance tax rules

The federal estate tax is calculated and paid before the estate is distributed to the decedents heirs. Kansas does not collect an estate tax or an inheritance tax.

Kansas Inheritance Laws What You Should Know

Many cities and counties impose their.

. Hire a good estate planning attorney. In the tax year 202122 no inheritance tax. Ad Inheritance and Estate Planning Guidance With Simple Pricing.

Kansas statutes dont provide a dollar amount or percentage of the estate that may be given as payment to the executor or administrator. The Kansas inheritance tax is based on the value of the assets received by the heir and the heirs degree of kinship to the deceased. All Major Categories Covered.

Kansas does not collect an estate tax or an inheritance tax. Select Popular Legal Forms Packages of Any Category. Does kansas have inheritance tax.

In 2019 that is. The personal estate tax exemption. Massachusetts and oregon have the lowest exemption levels at.

Kansas Probate and Estate Tax Laws. Kansas eliminated its state inheritance tax in 1998 and has not reinstated an inheritance tax as of March 2013. Open bank accounts and designate heirs as beneficiaries of the accounts.

The state sales tax rate is 65. Kansas does not have an estate tax or inheritance tax but there are other state inheritance laws of which you should be aware. Take out the guesswork with The Investors Guide to Estate Planning for 500k portfolios.

Ad The Leading Online Publisher of National and State-specific Wills Legal Documents. Kansas eliminated its state inheritance tax in 1998 and has not reinstated an. The estate tax is not to be confused with the inheritance tax which is a different tax.

In this detailed guide of the. Kansas residents who inherit assets from Kansas estates do not pay an inheritance tax on those inheritances. Up to 25 cash back 7031 Koll Center Pkwy Pleasanton CA 94566.

Kansas real estate cannot be transferred with clear title after the death of an owner or co. Kansas does not collect an estate tax or an inheritance tax. Like most states kansas has a progressive income tax with tax rates ranging from 310 to 570.

Kansas Inheritance Laws Probate Process. Once the probate case is opened in Kansas the executor is responsible for a number of duties. If you die without a will in Kansas your assets will go to your closest relatives under state.

If you received property from someone who died after July 1 1998 you do not. Kansas statutes dont provide a dollar amount or. Kansas does not have an estate tax or inheritance tax but there are other state inheritance laws of which you should be aware.

However if you are inheriting property from another state that state may have an estate tax that applies. However the Kansas Inheritance Tax may be payable even though no federal estate tax is due. Like most states kansas has a progressive income tax with tax rates ranging from 310 to 570.

Kansas residents who inherit assets from Kansas estates do not pay an. We have already discussed the fact that Kansas does not have an estate tax gift tax or inheritance tax. However if you are inheriting property from another state that state may have an estate tax that applies.

It consists of an accounting of everything you own or have certain interests in at the date of death. Ad From Fisher Investments 40 years managing money and helping thousands of families. The inheritance tax applies to money or assets after they are already passed on to a.

However it does address the issue of compensation. The advantages of an inheritance cash advance in Kansas include.

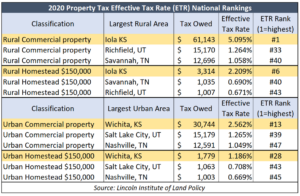

Kansas Has Some Of The Nation S Highest Property Tax Rates Kansas Policy Institute

Estate Tax And Inheritance Tax In Kansas Estate Planning

Grantor Trust Estate Planning Strategies To Implement Before The Biden Tax Proposals Take Effect Advicers Grantor Trust Estate Tax Estate Planning

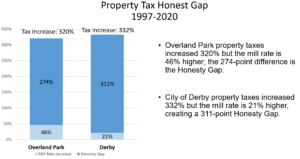

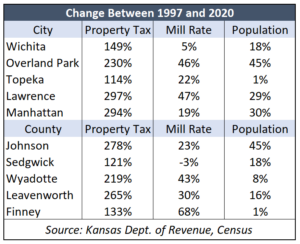

Gov Kelly Signs Property Tax Transparency Bill Kansas Policy Institute

Estate Tax And Inheritance Tax In Kansas Estate Planning

Delinquent Real Estate Unified Government Of Wyandotte County And Kansas City

Kansas Inheritance Laws What You Should Know

Kansas State Taxes Ks Income Tax Calculator Community Tax

Kansas Has Some Of The Nation S Highest Property Tax Rates Kansas Policy Institute

Gov Kelly Signs Property Tax Transparency Bill Kansas Policy Institute

Does Kansas Charge An Inheritance Tax

Kansas Inheritance Laws What You Should Know

Kansas State Taxes Ks Income Tax Calculator Community Tax

How New Kansas Laws Affect What You Pay In Property Taxes

Kansas State Taxes Ks Income Tax Calculator Community Tax

New Stimulus Package May Be Introduced Next Week Estate Tax Types Of Trusts Senate